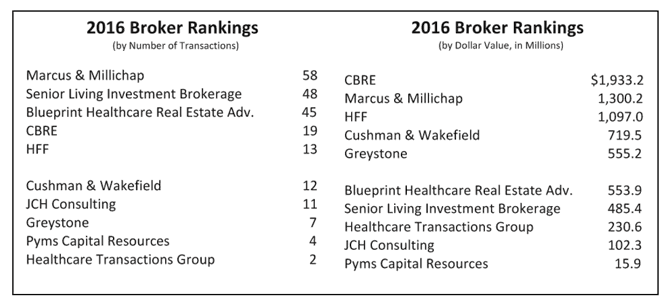

While it was not exactly a repeat of 2015, it came pretty close. This year we had only 13 brokerage companies reporting their numbers, with a few active brokers deciding to take a pass this year for a variety of reasons. But they would not have taken the top spots, so no worries on that account. Based on the number of transactions closed in 2016, Marcus & Millichap came out on top for the second year in a row with 58 separate sales in the seniors housing and care market. This was down a bit from the 64 sales in 2015, but the entire market had a mild slowdown. Taking the number two spot for the second year in a row was Senior Living Investment Brokerage with 48 sales, also down from their 63 transactions in 2015. In third place again was Blueprint Healthcare Real Estate Advisors with 45 transactions, but this was up significantly from their 29 deals in 2015. This is the youngest firm of the group and continues to grow. Rounding out the top five were CBRE with 19 transactions and HFF with 13 transactions.

When looking at the dollar amount of these transactions, CBRE rose from second place last year to first with $1.933 billion worth of sales, a 58% increase over 2015’s amount. Close behind was Marcus & Millichap with $1.3 billion, or 64% higher than in 2015. Rounding out the top five were HFF with $1.097 billion, Cushman & Wakefield with $719.5 million and Greystone with $555.2 million. Blueprint and Senior Living Investment Brokerage were close behind. The large numbers posted by CBRE, Marcus & Millichap and HFF were helped by three of the largest portfolio sales of the year, one in the assisted living sector (CBRE), one in independent living (HFF) and one in skilled nursing (Marcus & Millichap). Each of these was priced at $500 million or more, and can represent an outsized proportion of the dollar value of transactions completed. It was a great year for the brokerage firms, and it sounds like 2017 may be as busy as last year given the number of inquiries and RFPs sent out.