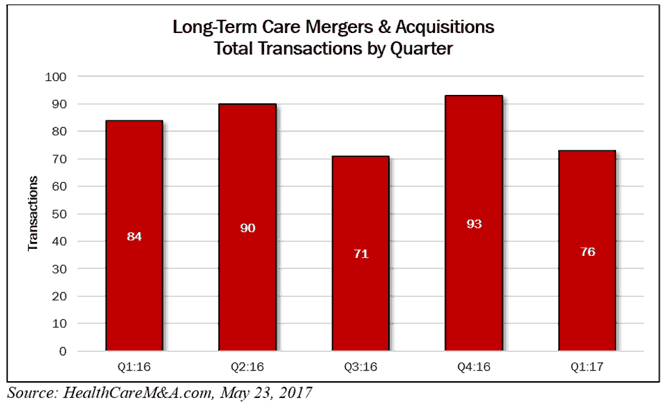

Long-term care has experienced a dip in M&A, but after nearly three straight years of 80+ transactions per quarter (starting in Q3:2014 with 83), with a couple exceptions, it is about time the M&A juggernaut slows down a bit. The first quarter’s volume fell to 76 deals, down from 93 in the previous quarter and from 84 in the year-ago quarter. And as of May 23, 2017, deal volume has so far not kept pace compared with the same period in 2016 with just 118 long-term care transactions recorded compared with 145 in 2016, a 19% difference.

However, spending has nearly doubled (to $7.52 billion so far in 2017 from $4.37 billion in 2016), thanks to a few large deals that were announced in the second quarter of 2017. But if you take out the transaction value of the Care Capital Properties–Sabra Healthcare REIT merger (which we calculate to be $3.996 billion based on the total amount paid to CCP shareholders plus $1.48 billion of debt), that dollar volume drops to $3.52 billion. And that includes two mega deals valued over $750 million too, whereas the highest purchase price during the same period in 2016 was just $569 million. So far, things have certainly cooled market-wide in 2017, at least in transaction volume.

But 2017 has become “The Year of the Big Deal.” In addition to Sabra and CCP’s merger, Kayne Anderson Real Estate Advisors also announced its $825 million purchase of Sentio Healthcare REIT, a public, non-traded REIT that was backed by investment firm KKR. Blackstone also made waves when it bought 26 seniors housing properties from Welltower, paying approximately $750 million, or $215,800 per unit. These big deals can often cause a domino effect throughout the industry, spurring a number of transactions, similar to when the private REITs fueled a buyers frenzy (and record high prices) in 2014 and 2015. Plus, Brookdale Senior Living remains a potential target, and we keep hearing of several very interested Chinese investors wanted to make their move in the industry, in a big way.