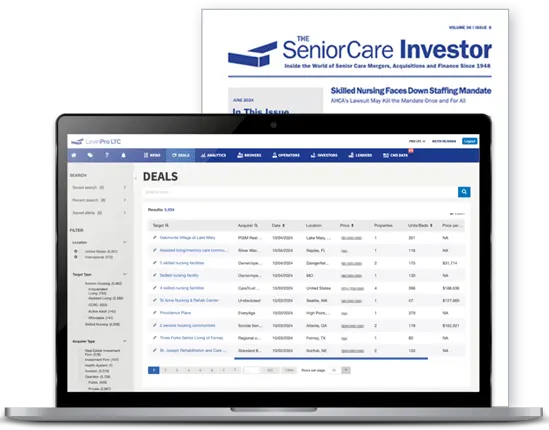

Get a Free 60-Day Trial to The SeniorCare Investor!

![]() M&A Intelligence

M&A Intelligence

Stay up-to-date on seniors housing and care M&A markets

![]() Industry Trends

Industry Trends

Keep up on the latest industry trends and sector developments

![]() Seniors Housing and Care Deals

Seniors Housing and Care Deals

Public & private deals that only our researchers have access to

Start Your Free Trial or Login to Your Account

Inside the World of Senior Care Mergers, Acquisitions and Finance Since 1948