Lancaster Pollard Charges Into Chambersburg

Lancaster Pollard, a division of ORIX Real Estate Capital, recently refinanced a senior living community in Chambersburg, Pennsylvania. Providence Place Senior Living, a family-owned operator that is headquartered in Hershey, Pennsylvania, owns the 17-acre campus, which features a mix of independent living, assisted living and memory care units. Monthly rates start at $3,082 for independent living, $4,122 for assisted living and $4,411 for memory care. It is located three miles from the Chambersburg Hospital. Miles Kingston, Doug Harper and Casey Moore of Lancaster Pollard secured an $11.5 million loan through its Fannie Mae Seniors Housing program. The loan came with a long term and... Read More »

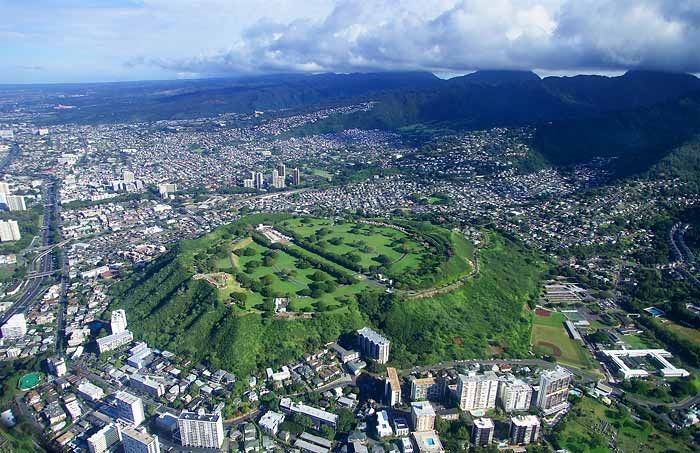

Lancaster Pollard Closes Hawaii SNF Refinance

Lancaster Pollard Mortgage Company followed up its HUD refinance of an assisted living/memory care community in Minnesota for a deal in a much more hospitable year-round climate. Doug Harper and Casey Moore of Lancaster Pollard headed to Honolulu, Hawaii (lucky guys) to arrange permanent financing for a senior living community located on the slopes of Punchbowl Crater, an extinct volcanic cone in downtown Honolulu. Owned by MW Group, Ltd., the community was built in 2003 and renovated in 2017. It currently consists of 68 independent living, 20 assisted living and 20 memory care units, and is one of six seniors housing and care properties in Hawaii operated by The Plaza Assisted... Read More »

Lancaster Pollard Refinances Minnesota Community

Working on behalf of a repeat customer, Lancaster Pollard Mortgage Company secured a HUD loan for a 138-unit assisted living/memory care community in Chaska, Minnesota (Minneapolis MSA). Developed by Trident Development and operated by the borrower, Tealwood Senior Living, which manages over 38 skilled nursing and assisted living facilities in Minnesota and Wisconsin, the property was originally developed in 2015. It was funded in part by Tax Increment Financing from the Chaska Economic Development Authority. The property consists of two buildings connected by both a ground-level breezeway and upper level hallways. There are 66 assisted living “light” units that are certified for... Read More »