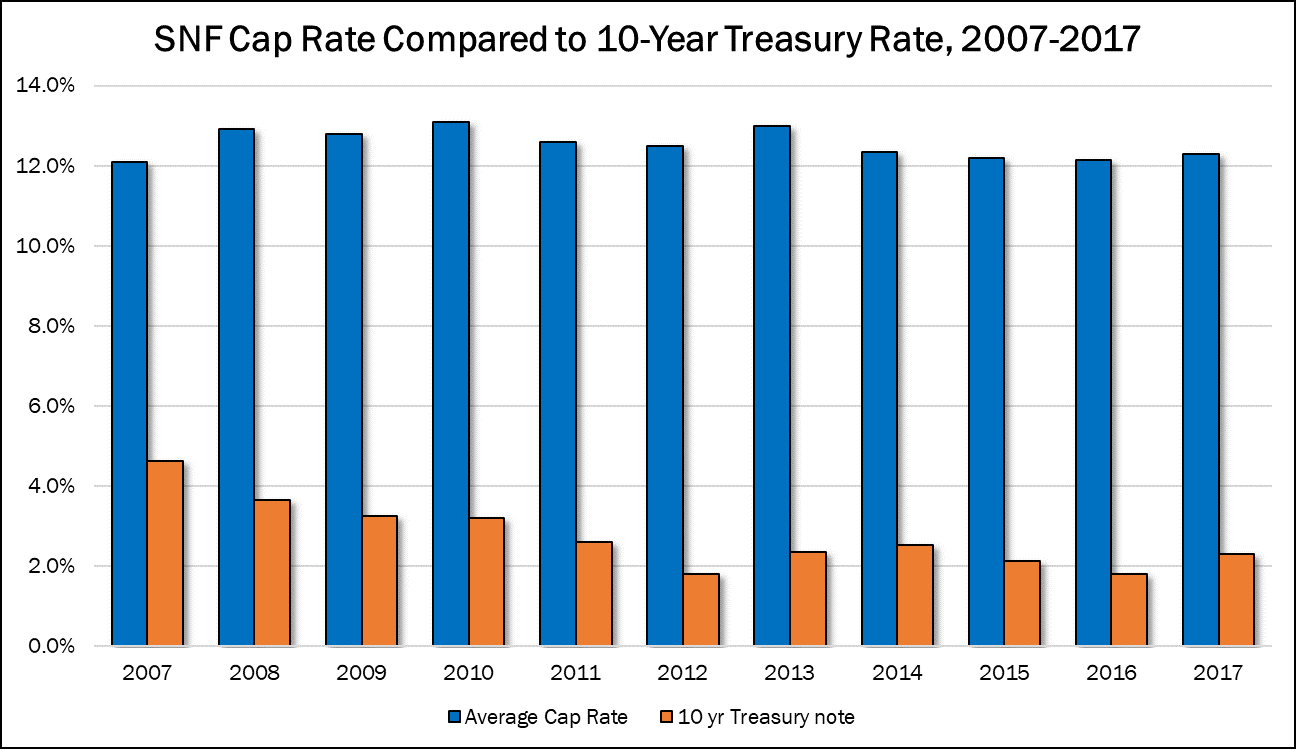

For the first year since 2014, the average 10-year Treasury note rate rose in 2017, and the increase was a relatively sizable 50 basis points to 2.3%. We say “relatively” because it has been so low and stable for so many years since the Great Recession that many investors have come to believe that interest rates will not rise significantly any time soon. That sentiment may be changing, however. The spread between the 10-year Treasury note and the skilled nursing cap rate was 1,000 basis points in 2017 (according to the 23rd Edition of The Senior Care Acquisition Report) and has essentially been around 1,000 basis points or wider since 2009.

This fact alone is part of the reason we have had a bull market for seniors housing and care acquisitions for nearly eight years. Such a wide difference between the cost of debt capital and the potential returns with 12% cap rates helps explain why, despite all the inherent risks, investors are still buying skilled nursing facilities. Investors need to remember, however, that at the last peak in 2007, the spread between the SNF cap rate and the 10-year Treasury was a low 750 basis points. Skilled nursing prices hit a new record that year, so changes in the spread may not always be as impactful on pricing as we would think.