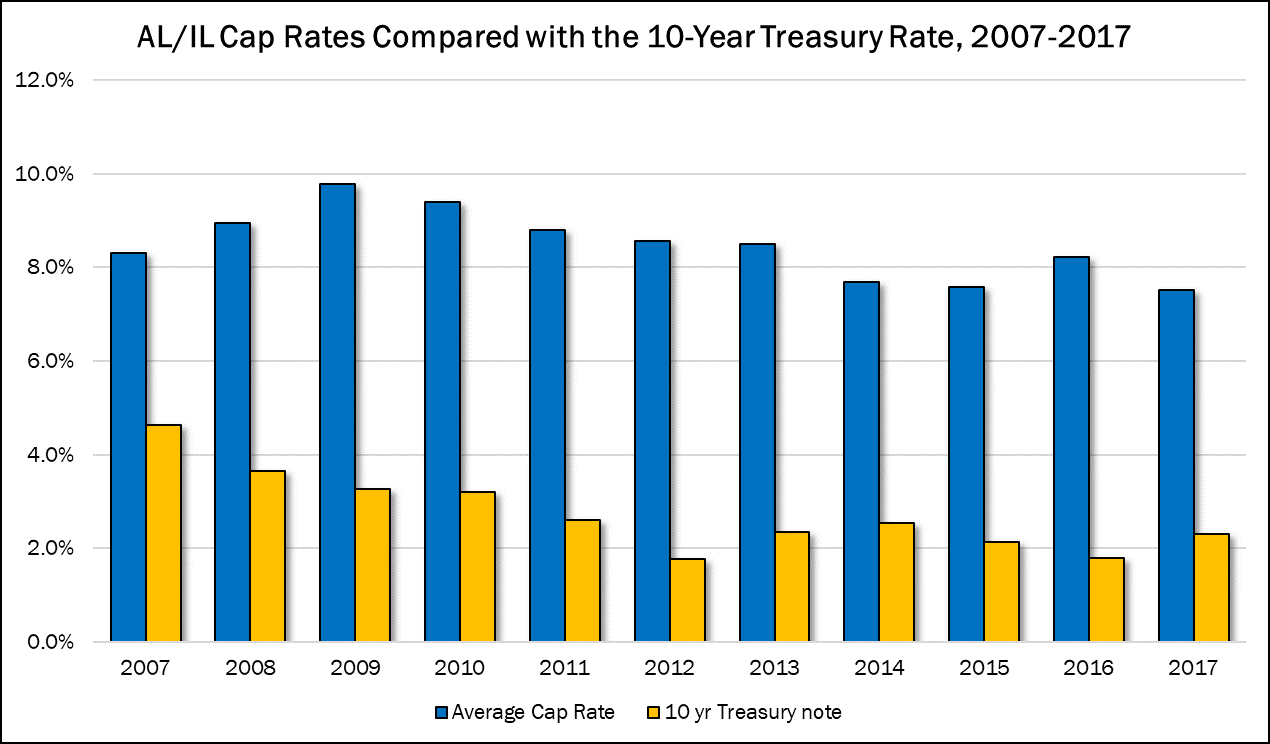

One would expect that in bull markets, the seniors housing (independent and assisted living) cap rate would fall, while the 10-year treasury rate would rise, making the spread between the two smaller, and vice versa for bear markets. But we have been in an historically low interest rate period throughout most of 2017, while at the same time in the midst of a continued bull market for seniors housing, highlighted by record-high prices and record-low cap rates. Per the 23rd Edition of The Senior Care Acquisition Report. The spread between the cap rate and 10-year Treasury Rate fell from 640 basis points in 2016 to 520 basis points in 2017, tied for the lowest seen in the last decade. That decrease in spread, along with continued signs from the Federal Reserve that interest rates will continue to rise in 2018 to combat potential inflation worries, may somewhat dampen investor enthusiasm in the sector, which has been driven by abundant and low-cost capital. At the same time, seniors housing continues to offer the highest yields among other commercial real estate sectors.