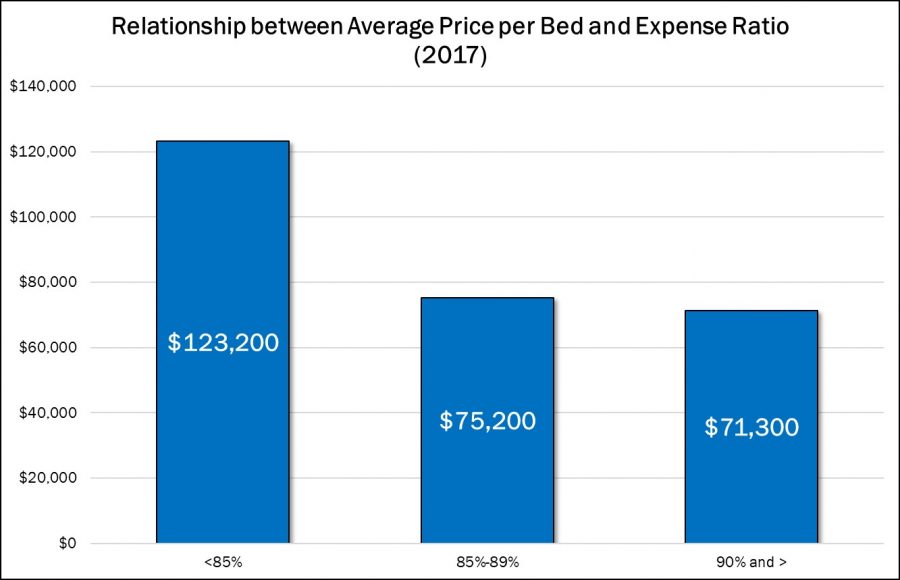

For the fifth year in a row, there has been a perfect correlation between the average price per bed and the expense ratio of those skilled nursing facilities sold, according to the 23rd Edition of The Senior Care Acquisition Report. This makes perfect sense but does not always happen when you have skilled nursing facilities in good markets that are mismanaged, usually on the expense side, but often combined with low Medicare utilization. Even though the operating margin (the inverse of the expense ratio) is important and can impact value in the acquisition market, it is the absolute level of cash produced at the facility that is always the most important factor. If there is a low expense ratio (high margin), then the value should rise.

As can be seen below, the average price paid per bed for those nursing facilities sold with an expense ratio below 85% was 64% higher than those facilities with an expense ratio between 85% and 89%. In other words, buyers are still paying up for higher than average cash flow despite the difficult operating environment. In 2017, all three categories below decreased from their levels in 2016. The main difference is that the two higher expense ratio categories were close together with their respective average price per bed.