We are fast approaching the publishing of our Senior Care Acquisition Reports, which we’ve split for the first time into the Skilled Nursing Acquisition and Investment Report and the Seniors Housing Acquisition and Investment Report. You can expect these Reports to hit your desk sometime in the next few weeks, if you order them, of course. In them, we’ve included more graphs, stats and analysis than ever before, along with comprehensive lists of the industry’s operators, private equity firms, REITs, lenders and brokers. Here is a taste of what you’d find:

Source: The 2019 Skilled Nursing Acquisition and Investment Report

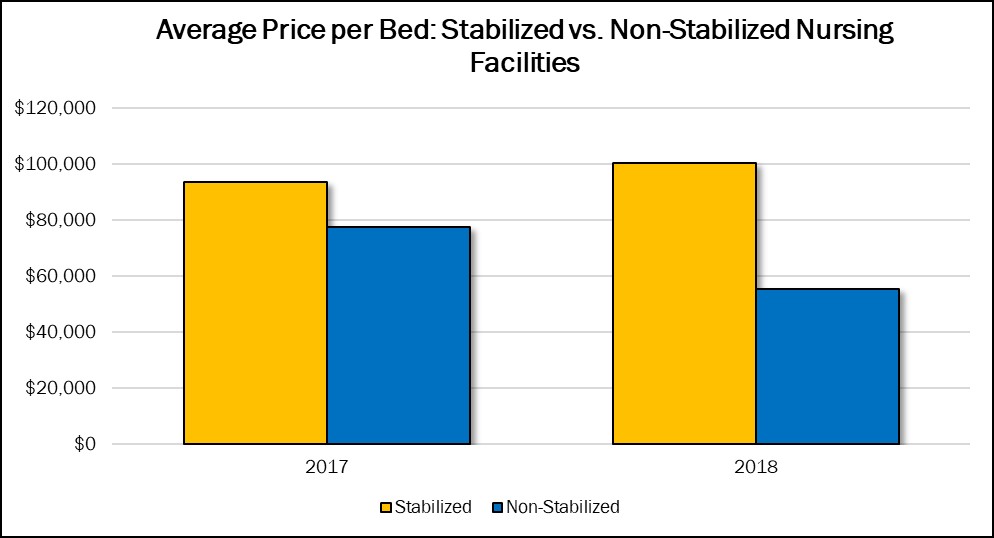

Traditionally, we have defined stabilized occupancy for skilled nursing facilities as 85% and higher. Given the continual decline in census for the nation’s nursing facilities, it is no longer clear where “stabilized” is in today’s market, especially as lengths of stay have shortened. An 80% occupied facility could still be profitable (and even thrive) with the right census mix. At the same time, an existing facility with a strong census should imply a robust referral network, good location and a solid staff, and would command a premium. We saw an increase in the average price paid for a stabilized facility from $93,700 per bed in 2017 to $100,600 per bed in 2018. Meanwhile, non-stabilized facilities, facing numerous headwinds like staffing costs, aging buildings and, clearly, falling occupancy, dropped in value from $77,750 per bed to $55,700 per bed. The average cap rates for these facilities were also slightly different, averaging 11.7% for stabilized properties and 12.05% for non-stabilized. This all makes sense given the overall polarization of the market.