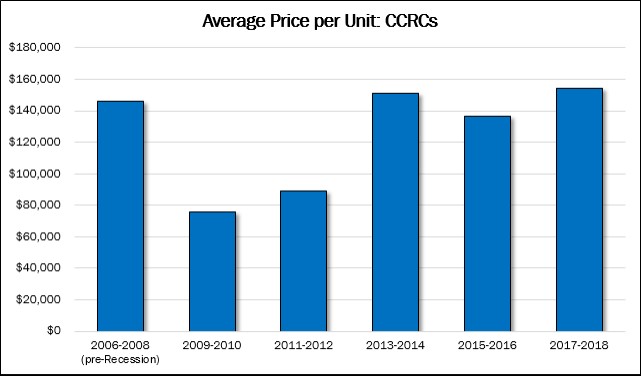

The CCRC (or LPC) acquisition market, which we highlighted in the First Edition of The Seniors Housing Acquisition & Investment Report, is the thinnest of all the major sectors of seniors housing and care. The number of potential buyers is smaller, the lender and investor pool is smaller, and the number communities for sale each year is smaller. Because the market is not very active, we have grouped our statistics in two-year intervals (with the exception of the three-year period before the Great Recession) to minimize the impact of outlier sales at both extremes.

Anecdotally, we have heard that the CCRC market is possibly faring the strongest of the seniors housing sectors. There has not been rampant new development, which mitigates labor and discounting costs, and there is persistent demand for the continuum of care CCRC model from consumers. Also, if CCRCs are targeting younger residents to move into their IL units, then the front end of the Baby Boomers should theoretically start moving in soon, if not now. Those are big ifs. Countering that confidence in the CCRC market is the impact a recession and/or falling home values can have on the market.

The sector is still dominated by not-for-profit providers, and they tend to be long-term owners unless one of their communities runs into financial problems. Usually, that means at least half of the transactions involve underperforming CCRCs, which is why they are being sold and why the average value for CCRCs regularly falls below that of seniors housing overall on a per-unit basis. With that, the average price per unit for the most recent period between 2017 and 2018 rose to a record-high of $154,000 per unit but essentially matched with the two other high periods before the Great Recession (2006-2008) and at the height of the post-Recession recovery in 2013 and 2014.