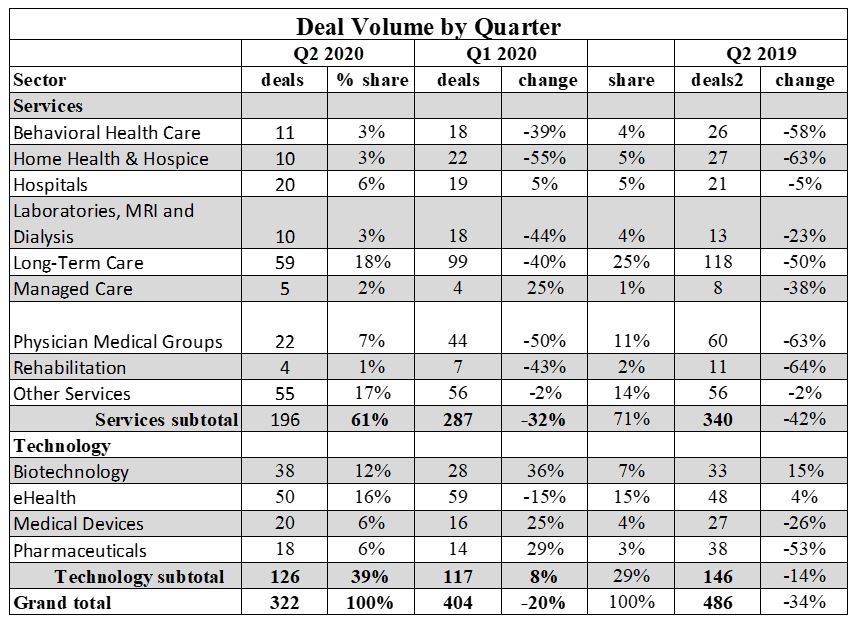

The decline in second quarter healthcare M&A probably won’t surprise many of our readers. The second quarter was the first full quarter of healthcare M&A in the shadow of the COVID-19 pandemic, and deal making took a hit as a result, as shown in results from our Deal Search Online database. Compared with Q1:20, Q2:20 dropped 20%, with 322 transactions on the books. Compared with Q2:19 (486 transactions), deal volume in Q2:20 declined even further at 34%.

Long-Term Care and Physician Medical Groups were among the hardest hit sectors, declining 40% and 50% in activity compared with Q1:20, respectively. Year-over-year, the difference is starker. Long-Term Care transactions dropped 50% compared with Q2:19, and Physician Medical Groups plummeted 63%. As we’ve written before, the PMG sector suffered from the pause on elective surgeries, which accounts for a majority of their revenue, forcing practices and their private-equity sponsors to spend resources to adjust to the COVID-19 pandemic.

Although M&A deal volume for the services sectors declined in Q2:20, the technology sectors fared out a little better. Compared with Q1:20, the technology sectors saw a modest 8% gain in deal volume in Q2:20. Activity still dropped by 34% compared with Q2:19, but the quarter-over-quarter gain is promising nonetheless. Deal volume in the Biotechnology sector posted the largest increase in Q2:20, rising 36% compared with Q1:20 and 15% compared with Q2:19.

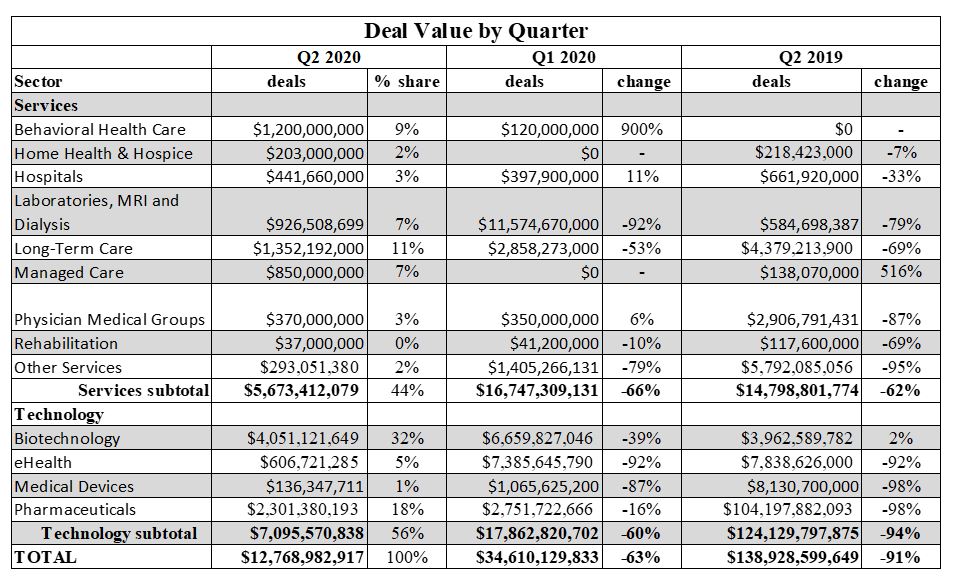

Dollar volume for Q2:20 declined even further, with only $12.8 billion in announced transaction values. Compared with Q1:20, announced dollar volume declined 63% and 91% compared with Q2:19. However, it’s important to note that the large gap between Q2;20 and Q2:19 dollar volume can be attributed to the merger of AbbVie Inc. and Allergan plc valued at $87 billion.

The deal value in technology sectors declined just as dramatically. Compared with Q1:20, the total value of announced prices dropped 60% to $7.0 billion, even hitting a 92% and 87% decline in the eHealth and Medical Device sector, respectively.