Joint Venture Enters Kansas

Senior Living Investment Brokerage facilitated the sale of a seniors housing community in Olathe, Kansas. Built in 1978 with an extensive remodel in 2016 and a 60-unit independent living expansion project in 2020, Anthology of Olathe comprises 60 independent living, 68 assisted living and 28 memory care units. The seller was a national owner/operator, and the buyer was a joint venture between an East Coast-based private equity group and Willow Ridge Senior Living. This is its first acquisition in Kansas. Jason Punzel, Jeff Binder, Dan Geraghty and Dave Balow handled the transaction. There were multiple offers for the community, and the selected joint venture buyer intends to continue... Read More »

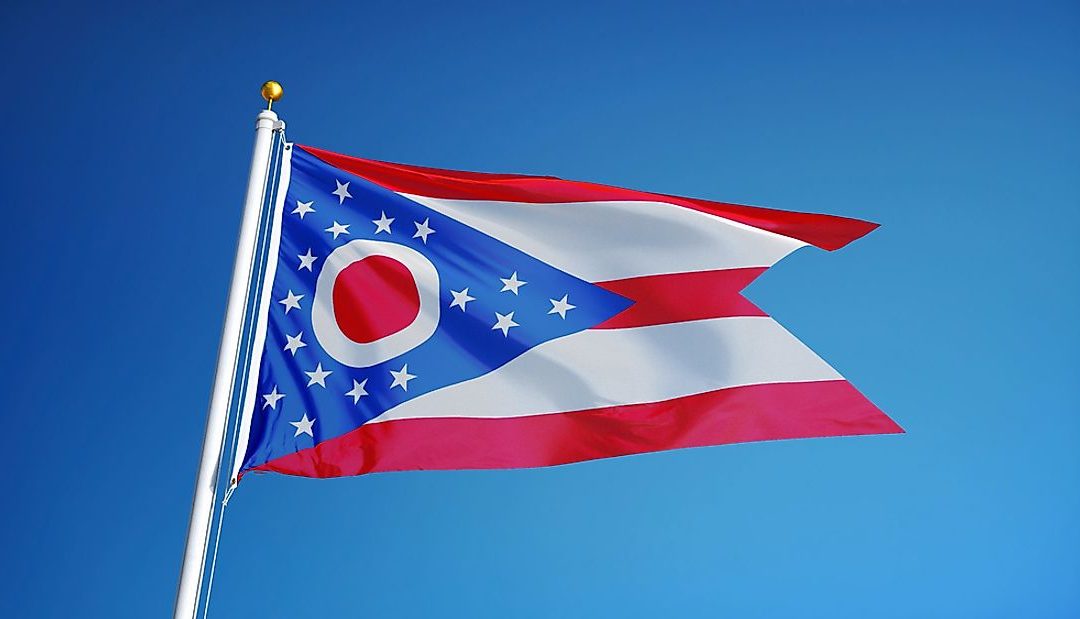

Owner/Operator Acquires AL/MC Portfolio in Ohio

A northeastern Ohio portfolio of assisted living/memory care communities sold out of receivership, with the help of Ryan Saul of Senior Living Investment Brokerage. Dubbed “The Lantern Group Portfolio,” the three communities feature a combined 220 units, split between 135 assisted living and 85 memory care units. Built in 1960, Lantern of Madison is located about 40 miles northeast of Cleveland, Lantern of Chagrin Valley (built in 1976) is just 15 miles southeast of Cleveland, and Lantern of Saybrook (built in 2015 in the town of Ashtabula) is halfway between Cleveland and Erie, Pennsylvania. Mike Flanagan was brought in as the receiver of the portfolio, who then hired Everest... Read More »

Tennessee Buyer Purchases Wisconsin Assets

Senior Living Investment Brokerage sold The Sage Meadow Portfolio, which included a Residential Care Apartment Complex (RCAC) and a Community-Based Residential Facility in eastern Wisconsin, approximately 60 miles from each other. Sage Meadow of Fond du Lac features 40 units and was built in 1997 and 2001. Sage Meadow of De Pere (near Green Bay) also has 40 units and was built in 2002. Combined, the communities were 92% occupied and operated at a 20% margin on $4.14 million of estimated revenues. A private equity group with holdings across the Midwest sold the assets to a Tennessee-based group with other holdings in Wisconsin for $8.5 million, or $106,250 per unit, at a 9.7% cap... Read More »

Inland Acquires Two Communities in Minnesota

The Inland Real Estate Group of Companies, Inc. acquired two seniors housing communities in Minnesota from Axial Real Estate Advisors LLC in an off-market transaction. Built in 2013, Kingsley Shores Independent Senior Living is in Lakeville and comprises 83 independent living, 49 assisted living and 22 memory care units. Occupancy was 91% at the time of closing. The community includes Kingsley Place, an active adult community with 55 units. Built in 2015, Savage Senior Living at Fen Pointe is in Savage and features 69 independent living, 30 assisted living and 24 memory care units. Occupancy was 98% at the time of closing. The Waters Senior Living will manage these communities moving... Read More »