What’s Up With 55-plus Communities?

A sector we have not traditionally covered but has been receiving more and more attention lately is the 55-plus senior apartment market. The property type does not feature the services like a common dining room (with a meal plan) or laundry that distinguishes independent living from strictly senior apartments, and so, it fell out of our “senior care” scope. However, with so much attention diverted to assisted living and memory care in recent years by many in the industry, some (both veterans and newcomers alike) are betting that the senior apartments sector is the perfect low-profile investment that still takes advantage of the Baby Boomer wave inching towards retirement age and beyond.... Read More »

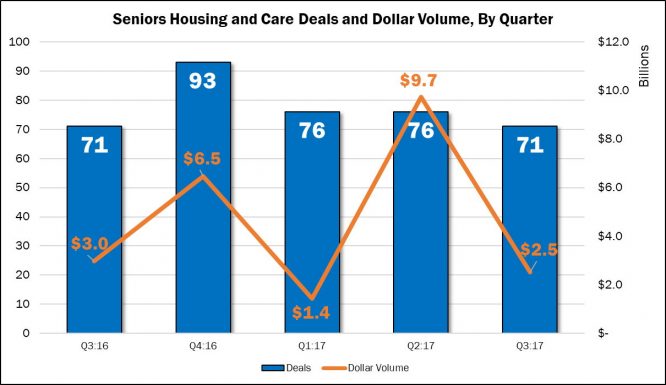

Third Quarter M&A Results Are In

We will be addressing the quarterly seniors housing and care M&A results in both the October issue of The SeniorCare Investor, as well as in our Health Care M&A Quarterly Report, which covers all 13 health care sectors. But, here is a preview: Although it remained above 70 deals for the quarter, seniors housing and care M&A activity fell to a year-low, tying with last year’s third quarter at 71 publicly announced transactions. Dollar volume also fell from its recent peak of $9.7 billion in the second quarter of 2017, recording $2.5 billion in transaction value based on disclosed prices. Increasingly, we have seen buyers prefer the one-off deals that come with one or two... Read More »

Takeaways From Fall NIC Conference

Last week’s NIC conference displayed the growing divergence of opinion on the state of the seniors housing and care market. A lot of people have asked me what I thought about the recent NIC conference in Chicago. Well, I have been covering the seniors housing and care sector for 30 years, I have attended all 27 fall conferences, but never have I heard such divergent opinions regarding the state of the market as I did last week. On the one side, you have those who are hoarding their cash, or raising new money, waiting for the market to take a plunge so they can take advantage of cheap prices. Most of these people have been around for a while, and like me, let their historical... Read More »

Should Diversicare Health Be Worth Double Its Current Price?

Although Diversicare Health and a few others may disagree, it is not always a bad thing to have an activist shareholder or two as investors in your company. They can keep you on your toes, force you to look at options to enhance value that you may not be considering, and their actions often result in publicity for an “undervalued” stock that may bring other shareholders in, which should help in driving the price up. Diversicare Health is a small company, with a stock market capitalization of around $70 million. It has been growing, but mostly with new leases which did not need much capital to acquire. That is good news, at least on the capital side. Currently, about 19% of the skilled... Read More »