Welltower Sets Stage for Further Growth

Welltower has already been the most prolific acquirer in the seniors housing M&A market in the last couple of years, but the REIT shows no signs of slowing, according to its latest earnings report and business update. In the second quarter, Welltower completed $1.7 billion of pro rata gross investments, including $1.4 billion in acquisitions and loan funding and $251 million in development funding. Contrary to most investors these days, that included the opening of 13 development projects, including partial conversions and expansions, for an aggregate pro rata investment amount of $214 million. On the sales side, Welltower also completed around $578 million of property dispositions and... Read More »

Prime Healthcare’s Largest (Pending) Acquisition

Prime Healthcare has entered into an asset purchase agreement with Ascension for the sale of four senior living facilities (as well as nine hospitals) in Illinois. Upon completion, this acquisition will be the largest in the history of Prime Healthcare and the Prime Healthcare Foundation, a 501(c)(3) public charity. The transaction includes the following senior living communities currently operated by Ascension: Fox Knoll Village (Aurora), Villa Franciscan Place (Joliet), Heritage Village/Heritage Lodge (Kankakee) and Resurrection Place (Park Ridge). As part of the acquisition, Prime is committed to investing $250 million in facility upgrades, capital improvements, substantial technology... Read More »

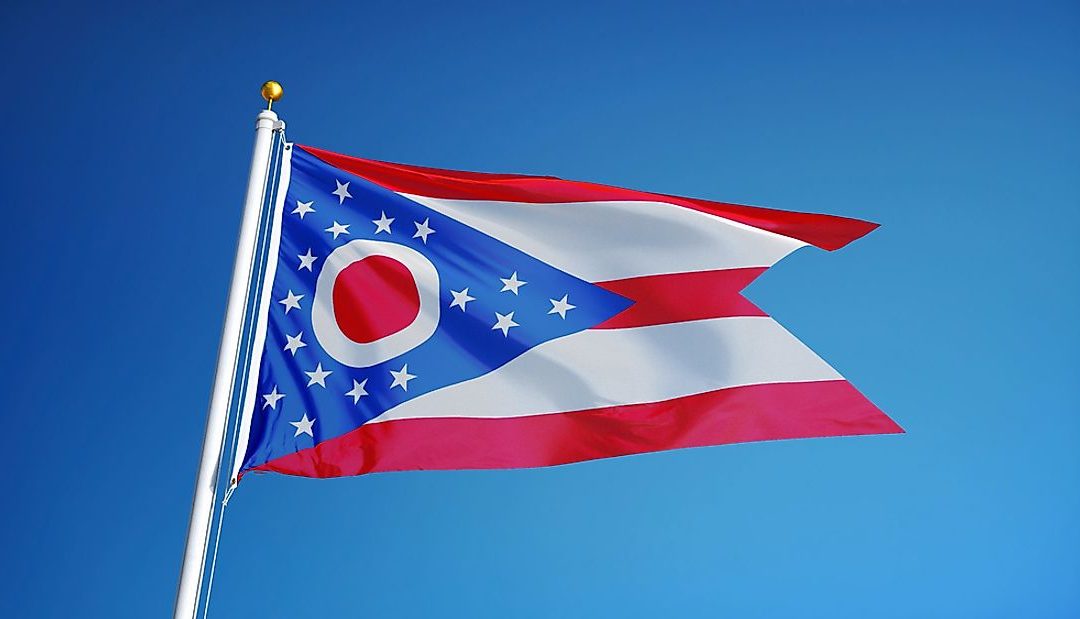

Evans Senior Investments Handles Ohio Portfolio Deal

Evans Senior Investments facilitated the sale of a three-property portfolio in western Ohio on behalf of Mariner Management Group, an owner/operator that is seeking an exit from the industry. Built in stages between 1990 and 2013, the three campuses comprise 317 skilled nursing beds and 209 seniors housing units. At the onset of the marketing process, the average occupancy rate was stagnant at 65%, resulting in financial challenges. There is room for improvement through leveraging hospital relationships, and, Ohio recently increased its Medicaid rate for assisted living waivers with reimbursement at $130 per day for base care. Evans targeted a select group of qualified buyers,... Read More »

Shell Point Retirement Community Secures Expansion Financing

Ziegler announced the closing of the Series 2024A/B bonds on behalf of Shell Point Retirement Community. The not-for-profit organization Christian and Missionary Alliance Foundations is doing business as Shell Point Retirement Community. Shell Point currently comprises 1,334 independent living units, 356 assisted living units and 180 skilled nursing beds in Fort Myers, Florida, on 700 acres. Shell Point will use the proceeds of the Series 2024A/B bonds to construct 58 independent living units to be known as Vista Cay. The Vista Cay residences will be 14 stories tall on 11.6 acres. Vista Cay will further expand the choice in residences across the existing community, broaden the... Read More »

Pegasus Senior Living Expands in Texas

Pegasus Senior Living took over management contracts for eight senior living communities in Texas and New Mexico. Previously operated by LifeWell Senior Living and developed by Pinpoint Commercial, the portfolio comprises 652 assisted living and memory care units. A small group of investors primarily based in Houston owns the communities. The transition is set to occur September 1, and LifeWell will still operate active adult communities after the transition. Pegasus now operates 43 senior living communities across 13 states, and its goal before the end of the year is to increase average occupancy to 90%. Read More »

Ensign Continues To Rock

When quarterly earnings season hits, we have always been nervous about some company reporting unexpected bad news and maybe sending shock waves through the industry. The one exception is The Ensign Group, which rarely, if ever, has had a negative surprise. They did not disappoint us with their second quarter results. We have been waiting for Harvard Business School to do a case study on how to run, and grow, a primarily nursing home company at a time when so many providers seem to struggle. We are four and a half years past the beginning of the pandemic, which should not be used as an excuse anymore, but Ensign does not need any excuses. Everything was up in the second quarter, except for... Read More »

Family Office Acquires Florida Seniors Housing Portfolio

Berkadia facilitated the sale of a four-property assisted living and memory care portfolio along Florida’s West Coast. Brooks Minford closed the transaction on behalf of two separate sellers. The buyer of all four properties, a Central Florida-based family office looking to expand its existing footprint, finalized the closings on July 23. The total purchase price was $42.55 million, or $127,400 per unit. In the first transaction, a Florida-based seniors housing and multifamily developer sold an early 2000s-build community comprising 59 assisted living and 20 memory care units. Occupancy was hovering around 85%, and it was stabilized at the time of the sale. The seller was divesting because... Read More »

Forest Facilitates Florida SNF Acquisitions

Forest Healthcare Properties handled two separate skilled nursing transactions in Florida. First, engaged by a regional owner/operator looking to exit the Tampa and Orlando MSAs, Forest helped facilitate the sale leaseback for a portfolio of seven SNFs. Built in 1980, the portfolio encompassed 866 beds with an occupancy rate above 90%. At the time of sale, the portfolio was not stabilized. The buyer was a regional owner/operator with a presence in Georgia and North Carolina and was looking to expand into Florida. Jeffrey Vegh and Joe Schiff handled the transaction, which involved the approval of three different banks due to the existence of three separate loans. Interest in the... Read More »

The Zett Group’s Summer Surge

The Zett Group, a brokerage firm focused on the Pacific Northwest, has hit a rich vein of activity, closing four separate transactions in recent weeks. Blake Bozett handled the transactions, with even more deals to be announced soon. First, built in 2006, Streamside Assisted Living and Memory Care features 79 assisted living and memory care units in Nampa, Idaho. It was stabilized at the time of sale. The seller was Ohana Ventures, and the buyer was Titan SenQuest, which was looking to expand its footprint within the state. The transaction navigated through various fire, life and safety needs that arose from the licensure inspection. Upon securing the listing agreement, Bozett made one... Read More »