Marcus & Millichap Refinances Georgia Community

Marcus & Millichap Capital Corp. arranged an $8.3 million loan to refinance Brookside Commerce, an assisted living community in Commerce, Georgia, approximately 70 miles northwest of Atlanta. Built in 1998, the 62-unit community includes 12 independent living units and is 3.5 miles from Northridge Medical Center, a full-service community hospital. It was acquired in September 2019 with another community in Stone Mountain, Georgia, for a combined $9.75 million, or $104,000 per unit. At the time, it was 93% occupied and had been recently renovated. A New York-based private equity firm was the buyer and secured a bridge loan through CBRE’s multifamily bridge lending program, MF1 Capital,... Read More »

Sonata Senior Living Announces Women-Only Memory Care Program

Sonata Senior Living has announced the expansion of Serenades for her, a new, women-only memory care lifestyle option. This program, originally launched in Serenades at West Orange, Florida, will now be offered in two neighborhoods in Serenades at the Villages and Serenades at Longwood, both in Florida. Serenades for her will also be a brand-new lifestyle option at Sonata Boynton Beach in South Florida. Read More »

Harrison Street Acquires Two Colorado Communities

Harrison Street acquired two Colorado senior living assets from CA Ventures, for an undisclosed price. The deal included the Westminster community totaling 137 units nine miles northwest of downtown Denver near a prominent retail corridor and residential neighborhoods. The upscale senior living community includes 107 assisted living units and 30 memory care units. The other target was the Englewood community, which totals 130 units seven miles south of downtown Denver and features unobstructed views of the Rocky Mountains and Cherry Hills Country Club. The property comprises 106 assisted living units and 24 memory care units across seven stories. Despite opening in February 2020, the... Read More »

60 Seconds with Swett: Giving Thanks in 2022

It’s been yet another difficult year for the senior care industry with new curveballs coming from inflation and soaring interest rates and staffing woes continuing to hammer communities’ bottom lines. But on the eve of Thanksgiving, we can still find things to be thankful for in our industry. First and foremost, after more than two years of dealing with the pandemic and in most cases working while masked for their entire shifts, we are thankful to the senior care staff that showed up to work every day and provided great care for seniors. Our industry offers a good career path for millions of people, and thanks to most providers (and inflation), wages also increased in 2022 across the... Read More »

Connecticut SNF Portfolio Finds New Owner

Blueprint Healthcare Real Estate Advisors has arranged the sale of a Connecticut skilled nursing portfolio on behalf of a joint venture owner. The portfolio comprises three facilities totaling more than 380 units in the greater Hartford area. The facilities had historically maintained stable census levels with a steady stream of referrals and admissions from regional referral sources, including Hartford Hospital, Manchester Memorial and Rockville General. Multiple parties were interested in the portfolio, but it ultimately sold to a regional acquirer. The buyer plans to focus on operational efficiencies, including addressing excess staffing, as well as investing in capital projects at the... Read More »

NHI Arranges Texas SNF Portfolio Refinancing and Exercises Virginia Beach Acquisition

National Health Investors has funded the refinance of a skilled nursing facility portfolio in the state of Texas. The $42.5 million senior loan was provided to an affiliate of Capital Funding Group, and the properties are leased by subsidiaries of The Ensign Group. The five-year loan has an annual interest rate of 7.25% with two one-year extensions. The REIT also announced that it exercised its option to acquire Bickford of Virginia Beach, a 60-unit assisted living/memory care community in Virginia Beach. The acquisition was primarily funded with the satisfaction of a $14 million construction loan due from Bickford Senior Living. The community was added to an existing master lease with... Read More »

Cushman & Wakefield Arranges Pennsylvania Sale

Cushman & Wakefield announced it has arranged the sale of The Watermark at Logan Square, a 426-unit rental CCRC in Philadelphia, Pennsylvania. The firm also served as the exclusive advisor to the buyer in procuring acquisition financing from a national bank. Built in 1984, the 24-story building offers independent living, assisted living, memory care and skilled nursing. The property is located above the Logan Square circle and offers urban senior living in a fast-growing neighborhood of Philadelphia. Rick Swartz, Jay Wagner, James Dooley and Bailey Nygard represented the seller, procured the buyer and arranged the financing. Read More »

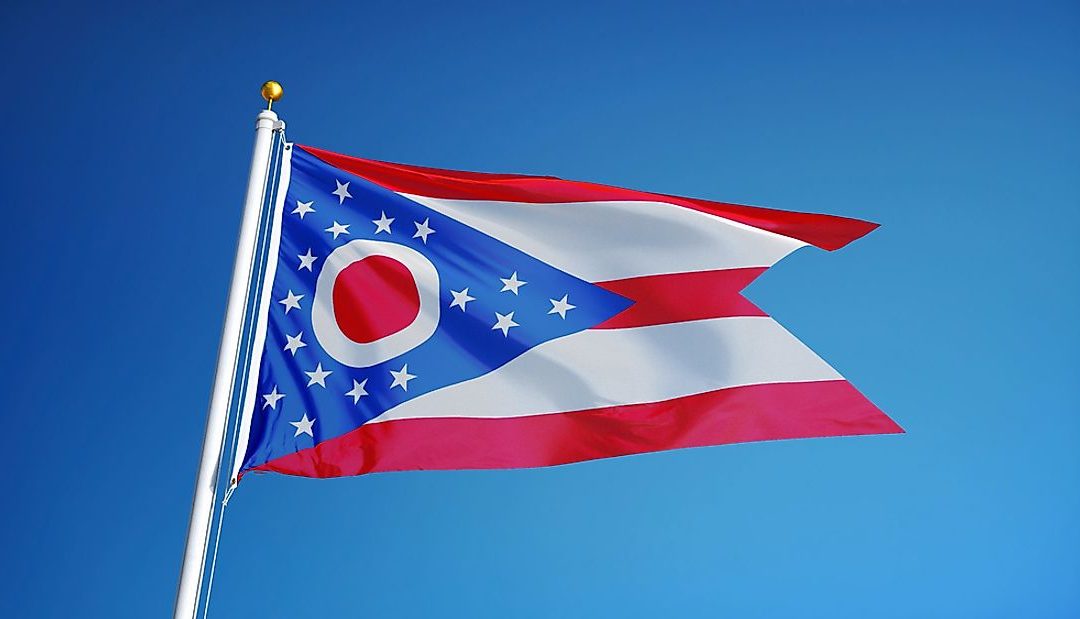

Ohio SNF Portfolio Sells to East Coast Group

Blueprint Healthcare Real Estate Advisors announced the sale of three skilled nursing facilities in the state of Ohio. Situated in Canton, Toledo, and Rockford, the facilities were built in the 1960s and 1970s and have undergone significant renovations since 2015. The portfolio comprises more than 300 beds and spans 200 miles across the state. The seller of the portfolio was an East Coast-based private equity investor whose intention was to recycle capital. The ultimate buyer was the current operator of the portfolio, another East Coast-based group with a strong presence in the local market. Connor Doherty, Ryan Kelly and Michael Segal of Blueprint Healthcare Real Estate Advisors handled... Read More »

Morning Pointe Receives $106 Million Refinance for Seniors Housing Portfolio

Tennessee-based affiliates of Morning Pointe Senior Living announced that they have received $106.2 million in financing for an eight-property seniors housing portfolio. Located across Kentucky (1) and Tennessee (7), the portfolio comprises a total of 567 units. Completed between 1997 and 2021, the seniors housing communities offer assisted living and memory care services, featuring a mix of studio, alcove, one- and two-bedroom floorplans. Neal Raburn of Greystone originated the Freddie Mac Optigo loans on behalf of the borrower. The fixed-rate, non-recourse financing was structured through Freddie Mac’s Index Lock program and carries a 10-year term with a 30-year amortization period. With... Read More »