Encore Acquires Largest Campus in Illinois

Newly launched Continuum Advisors, founded by David Kliewer and Jay Jordan, sprinted to the end of the year with several closings in the last week of December. First, Continuum arranged the sale of the largest senior living campus in Illinois. Friendship Village of Schaumburg was built in phases from the late-1970s to 2007 and features 512 independent living apartments, 28 IL garden homes, 85 assisted living units, 24 memory care units and 169 skilled nursing beds, or 818 units and beds, total. It sits on over 60 acres in the affluent Chicago suburb of Schaumburg, about 30 miles northwest of downtown. In 2017, Friendship Village refinanced its debt and funded campus renovations through a... Read More »

SLIB Handles Two REIT Divestments

Senior Living Investment Brokerage’s Brad Clousing and Dan Geraghty closed a couple of portfolio sales at the end of 2023 on behalf of a publicly traded REIT. The larger deal consisted of four assisted living communities and 173 total units in Florida. They are located in Spring Hill, Fort Myers, Niceville and Tallahassee. The portfolio generated interest from multiple parties, but Opal Senior Living ended up as the buyer, for an undisclosed price. Clousing and Geraghty also sold a portfolio of three assisted living communities with 128 total units in South Carolina to Mainstay Senior Living. According to an announcement from Mainstay, the acquired communities have been renamed to Ansley... Read More »

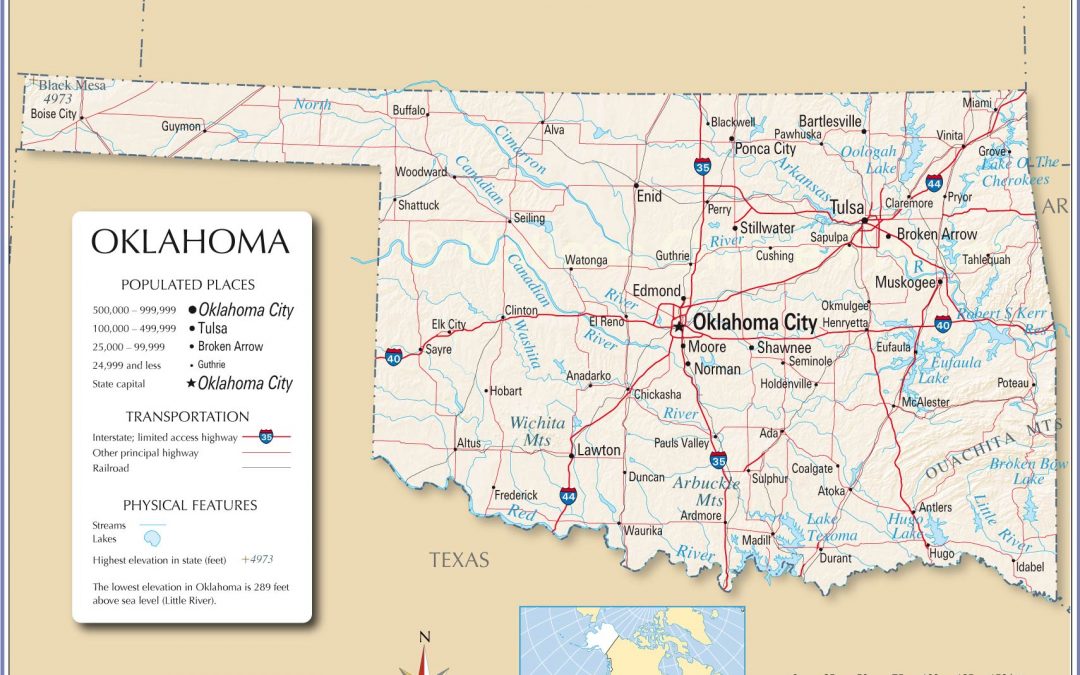

ESI Facilitates Sale of Oklahoma SNF

Evans Senior Investments facilitated the sale of a skilled nursing facility on behalf of a private owner/operator. The facility comprises 95 beds in Oklahoma and boasts a five-star rating, which attracted a competitive and qualified pool of potential buyers. The selected buyer was a private, West Coast-based investor with a history of skilled nursing operations and property ownership. The facility will be managed by a local operator that is expanding their footprint in the state. No other details were disclosed. Read More »

Not-For-Profit Owner/Operator Divests in Texas

Plains Commercial facilitated the sale of a skilled nursing facility on behalf of a not-for-profit seller looking to consolidate its operational footprint closer to its home office in Lubbock, Texas. The buyer is a Dallas-based owner/operator looking to grow its footprint. Built in 1965, Senior Village Nursing Home comprises 60 licensed beds in the rural town of Perryton in the panhandle of Texas. At the time of sale the facility was struggling from low census with around 20 occupied beds, and it was cash flow negative. The facility offers the buyer, Capstone Healthcare, significant upside through further lease-up and operational changes. Daniel Morris handled the... Read More »

SLIB Sells Chicagoland Portfolio

Fresh off an active 2023, Ryan Saul of Senior Living Investment Brokerage kicked off 2024 with a large closing in Chicagoland. A private, family-run company was looking to exit the skilled nursing space, prompting the sale of its three SNFs with 491 total beds for $51.2 million, or $104,300 per licensed bed. On a functional bed basis, the per-bed price rises to $111,500. The portfolio consists of Wauconda Care (149 beds), Fairmont Care (186 beds) and Oak Brook Care (156 beds). They are the premier nursing homes in the area and hold five-star ratings from CMS, plus JCAHO (Joint Commission on Accreditation of Healthcare Organizations) accreditation. Occupancy was healthy at 84%, with... Read More »

Carnegie Capital Secures Acquisition Financing

JD Stettin, Managing Partner of Carnegie Capital, helped finance the acquisition of a non-performing senior care campus in Dallas, Texas. The debt will also help cover around $9 million in planned renovations at the 119-bed campus. Built in 2001 with a recent 2018 renovation, Crystal Creek at Preston Hollow features a range of care levels including skilled nursing, assisted living and memory care. At the time of marketing, occupancy in both the seniors housing and skilled nursing was rapidly declining. Due to the skilled nursing component not being licensed to accept Medicaid, the campus consistently struggled to lease up the beds with Medicare & private pay residents, which resulted... Read More »

Shealy Launches Grace Hill Capital

Ziegler alum Adam Shealy founded Grace Hill Capital in December 2023, building upon nearly two decades of experience as a senior banker at leading investment banks in the United States and Europe. GHC is a specialized capital markets advisory firm dedicated to seniors housing and health care, headquartered in Sarasota, Florida. It currently offers tailored capital solutions for senior living investors, ranging from bridge and permanent debt for acquisition, refinance, recapitalization, construction and rehabilitation. GHC services also include specialized underwriting, capital structure advisory and debt placement services for skilled nursing, assisted living, memory care and independent... Read More »

BWE Secures Financing For Four Seniors/Affordable Housing Communities

BWE announced the closing of four financings totaling over $26 million to refinance, build and preserve four seniors and affordable housing properties in California, Massachusetts, Ohio and Florida. First, Max Sauerman originated a loan on behalf of Goldrich and Kest, two privately owned, family-run real estate companies, for Palm Court Senior Independent Living. The community was built in 1991 and is in Culver City, California. Next, Taylor Mokris and Ryan Stoll originated a five-year, $13.15 million fixed-rate, non-recourse Freddie Mac loan on behalf of an institutional owner for acquisition financing. The loan has a five-year term. Operated by Benchmark Senior Living, Branches of... Read More »

Colliers Closes Tampa Deal

Ken and Damien Carreiro of Colliers International closed out 2023 with a closing in Tampa, Florida. The pair sold Family Extended Care Of Central Tampa, a 57-unit assisted living community that was built in 1967 and completely renovated in 2005. The community was 80% occupied, but financials were not disclosed. Best Care Senior Living, an operator of seven seniors housing communities in Florida, emerged as the buyer. They paid $6.5 million, or $114,000 per unit, for the community. The seller provided financing with 20% down. Read More »