Quarterly Results Are In

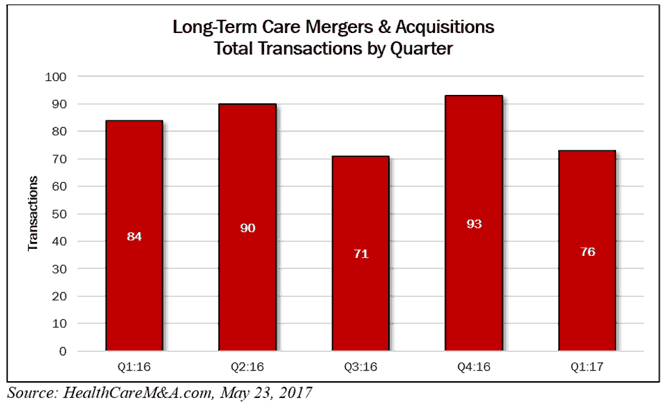

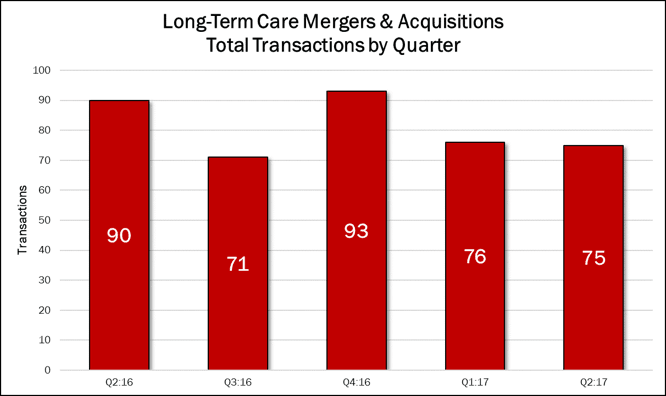

If you go by the number of transaction announced from April 1, 2017 to June 30, 2017, the second quarter may seem a bit slow, especially when compared to the recent quarterly highs of 90 deals in the second quarter of last year and of 93 deals in the fourth quarter of 2016. Keep in mind, these are preliminary numbers, as we hear of more transactions as the year goes on. M&A activity stayed virtually even in the second quarter, down 1% over the previous quarter, to 75 transactions. The quarter’s deal volume makes up 24% of the 315 deals announced within the past 12 months. Nothing too drastic there. However, based on revealed prices, approximately $9.7 billion was committed to finance... Read More »Big Deals Are Back

Big seniors housing and care companies are back in vogue as acquisition targets, and they are all occurring with the specter of a Brookdale Senior Living buyout looming over the market. First came Kayne Anderson Real Estate Advisors’ $825 million acquisition of Sentio Healthcare Properties and its portfolio of 34 seniors housing and medical office properties. Then, we learned of Sabra Health Care REIT and Care Capital Properties’ all-stock merger valued at nearly $4 billion. Now, in the midst of rumors that Brookdale is in exclusive talks with a Chinese investor (Zhonghong Zhuoye Group) for a potential sale valued at $3.0 billion, we learned of another major deal in the works. Columbia... Read More »

What Do The REITs Know?

When the Big Three healthcare REITs (Ventas, HCP and Welltower) largely divested their skilled nursing portfolios in the past few years, it prompted questions about the industry’s health. The exodus was kicked off in August 2015 by Ventas, which spun out most its skilled nursing/post-acute care portfolio into a separate REIT, Care Capital Properties (which just this month agreed to merge with Sabra Health Care REIT). Then, effective November 1, 2016, HCP followed suit, in a spin-off of its troubled HCR ManorCare assets (over 320 properties) into Quality Care Properties. Finally, after over a year of denying any such move, Welltower sold a 75% stake in 28 Genesis Healthcare-operated... Read More »