Seattle Seniors Housing Operator Develops Again

Merrill Gardens is growing yet again, through the development of two more assisted living/memory care communities in Washington and Georgia. This comes just months after Seattle-based Merrill and an unidentified partner bought out the majority stake owned by an affiliate of Heitman in a small portfolio of four senior living communities either developed or acquired in the previous couple of years. That sale was arranged by Cushman & Wakefield. But now, the company is growing again in a partnership with its sister company, Pillar Properties. First, in its hometown of Seattle, Merrill opened a community with 91 independent/assisted living and 10 memory care units, at a total development... Read More »

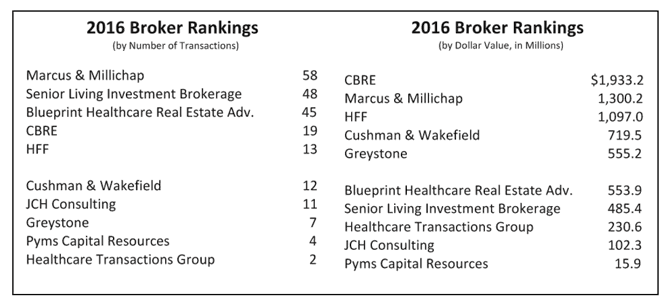

Marcus & Millichap and CBRE Top Senior Care Broker Rankings

While it was not exactly a repeat of 2015, it came pretty close. This year we had only 13 brokerage companies reporting their numbers, with a few active brokers deciding to take a pass this year for a variety of reasons. But they would not have taken the top spots, so no worries on that account. Based on the number of transactions closed in 2016, Marcus & Millichap came out on top for the second year in a row with 58 separate sales in the seniors housing and care market. This was down a bit from the 64 sales in 2015, but the entire market had a mild slowdown. Taking the number two spot for the second year in a row was Senior Living Investment Brokerage with 48 sales, also down from... Read More »

The Market of Lafayette

In the heart of Cajun country, Cushman & Wakefield’s Robert Black and Sean McNee facilitated the sale of two seniors housing communities on behalf of the local owner and operator. Both located less than a mile apart in Lafayette, Louisiana, the all-private pay properties included a 70-unit independent/assisted living community that was built in 1997 and a just-opened 37-unit memory care community. The buyer, Griffin-American Healthcare REIT IV will bring on Colonial Oaks Senior Living to operate the communities under a 15-year absolute net lease with two 10-year renewal options and annual rent escalators of 6.3% after year one and 2.5% thereafter. Griffin-American financed the... Read More »