Deals Down So Far in 2017

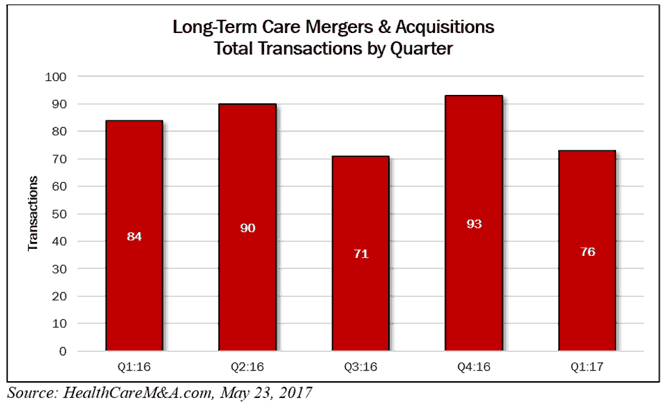

Long-term care has experienced a dip in M&A, but after nearly three straight years of 80+ transactions per quarter (starting in Q3:2014 with 83), with a couple exceptions, it is about time the M&A juggernaut slows down a bit. The first quarter’s volume fell to 76 deals, down from 93 in the previous quarter and from 84 in the year-ago quarter. And as of May 23, 2017, deal volume has so far not kept pace compared with the same period in 2016 with just 118 long-term care transactions recorded compared with 145 in 2016, a 19% difference. However, spending has nearly doubled (to $7.52 billion so far in 2017 from $4.37 billion in 2016), thanks to a few large deals that were announced in... Read More »Sentio Healthcare Properties Agrees To Sell

In breaking news, Kayne Anderson Real Estate Advisors announced that it entered into a definitive merger agreement to buy Sentio Healthcare Properties, which is partly owned by KKR (NYSE: KKR), in a transaction valued at $825 million. Kayne is paying $14.37 per Sentio share in cash about 11.5 million shares) with some upward adjustments that will most likely take the price to $14.65, with the deal expected to close in the third quarter. Sentio is a public, non-traded REIT that owns a mix of seniors housing properties and MOBs. Citigroup Global Markets and Holliday Fenoglio Fowler (nice month they are having) were the financial advisors to Kayne, and Robert A. Stanger & Co. and UBS... Read More »