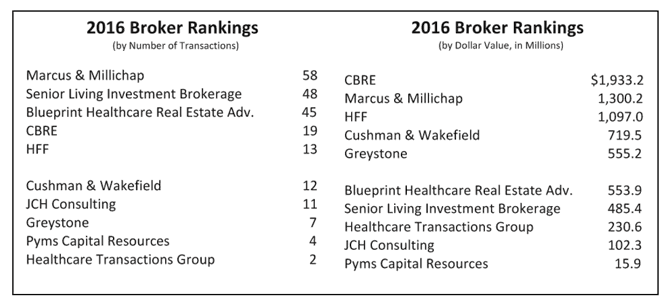

Marcus & Millichap and CBRE Top Senior Care Broker Rankings

While it was not exactly a repeat of 2015, it came pretty close. This year we had only 13 brokerage companies reporting their numbers, with a few active brokers deciding to take a pass this year for a variety of reasons. But they would not have taken the top spots, so no worries on that account. Based on the number of transactions closed in 2016, Marcus & Millichap came out on top for the second year in a row with 58 separate sales in the seniors housing and care market. This was down a bit from the 64 sales in 2015, but the entire market had a mild slowdown. Taking the number two spot for the second year in a row was Senior Living Investment Brokerage with 48 sales, also down from... Read More »

Pay up in Pennsylvania

Good and hard work is usually rewarded in this industry, and the single-asset private owner of an historically five-star rated skilled nursing facility in Lansdale, Pennsylvania is certainly retiring in style with the facility’s sale. Though the purchase price was undisclosed, we hear it sold for one of the highest prices per bed for a single-facility in Pennsylvania. Built in 1980 on just under six acres, the property was very well maintained and featured seven private rooms, 51 semi-private rooms and 24 three-bed wards. And in addition to a 96% occupancy, it also had strong cash flow. That operational success, combined with amenities like a business office, conference room, country... Read More »