Third Quarter M&A Results Are In

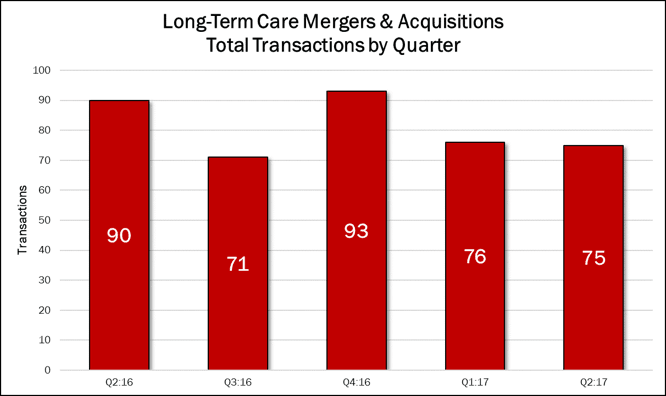

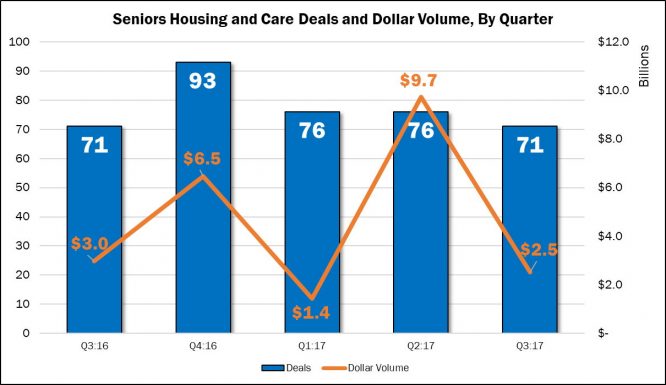

We will be addressing the quarterly seniors housing and care M&A results in both the October issue of The SeniorCare Investor, as well as in our Health Care M&A Quarterly Report, which covers all 13 health care sectors. But, here is a preview: Although it remained above 70 deals for the quarter, seniors housing and care M&A activity fell to a year-low, tying with last year’s third quarter at 71 publicly announced transactions. Dollar volume also fell from its recent peak of $9.7 billion in the second quarter of 2017, recording $2.5 billion in transaction value based on disclosed prices. Increasingly, we have seen buyers prefer the one-off deals that come with one or two... Read More »

Capital One Releases Survey Results

Capital One released its annual survey results from more than 150 senior executives about the 12-month outlook for various issues in seniors housing and skilled nursing. Despite record-high acquisition prices, 37% of the respondents believe acquisitions of existing facilities represent the biggest opportunity, with 30% believing repositioning existing properties represents the best opportunity. In addition, 89% believe the level of M&A activity will remain the same or increase in the next 12 months, split almost equally between the two. Regarding challenges in the next 12 months, 33% cited labor cost pressures and 32% cited supply/demand imbalances. Fewer than 10% were concerned about... Read More »

REIT Financing: RIDEA vs. Sale/Leaseback

During our recent webinar on REIT financing where we discussed the pros and cons of using the more traditional sale/leaseback structure, we posed a few questions to the audience. Let’s just say, the answers surprised us. The first was whether, if choosing REIT financing today, they would prefer the traditional sale/leaseback structure which involves fixed lease payments that increase every year, or the newer RIDEA structure, where they enter into a joint venture with the REIT and manage the properties for the joint venture. We assumed that most people would prefer the RIDEA structure given the nature of the sale/leaseback structure with 2.5% to 3.0% annual escalators. Wrong. A slight... Read More »

What Happens When You Weight A Cap Rate By Beds?

Partly due to historical precedent, we have always presented our cap rate analysis on an unweighted average basis, meaning that the cap rate for a portfolio of facilities would carry the same weight as that of a single 80-bed facility. For those who believe that portfolios will usually command a lower cap rate, then a weighted average would be the most accurate method to determine what is really happening in the market. Even a 200-bed facility acquisition, because of the implied increase in investment risk, should in theory be treated differently from that of a 50-bed rural facility. Consequently, a few years ago we went back and recalculated the cap rates to weight them based on the... Read More »