August Acquisition Volume Light, But Consistent

Can we call it a comeback when the seniors housing and care M&A market surpassed 20 deals in August? We recorded 21 publicly announced transactions in the month, which is the highest total since April when 22 deals were disclosed. Since April, there have been 20 deals announced in May, 18 in June and 20 again in July. Consistent, yes, but we just still aren’t used to seeing numbers like these after the heady times of 2018 and 2019 when buyers regularly made 40 transactions or more in a month. Through the end of August, the seniors housing and care M&A market reached 200 deals announced in 2020, so far. Roughly half of that total came in the first quarter, which was... Read More »

CareTrust REIT Adds Two Montana SNFs

One of the more consistently active acquirers in the skilled nursing market is back. CareTrust REIT just made its first post-COVID acquisitions for two skilled nursing facilities in Montana. The off-market transaction consisted of Apple Rehab Cooney, an 80-bed facility located on the campus of the St. Peter’s Health Regional Medical Center in Helena, and Elkhorn Healthcare & Rehabilitation, a 70-bed facility in nearby Clancy. Eduro Healthcare took over operations. CareTrust paid around $16 million, or $106,700 per bed, for the facilities, inclusive of transaction costs. In addition, the REIT will provide around $500,000 for Eduro to improve the properties, which are... Read More »

Joint Venture Develops D.C.-Area Senior Living Community

In a joint venture with Flournoy Development Group, Cadence Living has broken ground on a new senior living development in Olney, Maryland (Washington, D.C. MSA). Set on 37 acres that includes 31 acres of forest preserve, which residents will be able to take full advantage of, the community will feature a three-story, 75-unit independent living and assisted living building and a two-story, 32-unit memory care building, for a total of 107 units. There will also be plenty of indoor and outdoor amenities. When it opens in 2022, this will be Cadence’s first community in Maryland, and first in the Mid-Atlantic region. Same thing for Flournoy Development, which was previously focused on the... Read More »

Recent Senior Care M&A Deals, Week Ending September 4, 2020

August had just 20 publicly announced senior care transactions, and the start of September was also slow. Here are the recent deals. Long-Term Care AcquirerTargetPrice AZ-based owner/operator2 assisted living/memory care communities in CON/A O&M InvestmentsVilla Toscana at Cypress Woods$5.3 million FL-based owner/operatorInsignia of Towne Lake$2.9... Read More »

O&M Investments Makes Two SNF Acquisitions in Texas

A skilled nursing facility in an affluent Houston, Texas suburb found a new owner thanks to expertise of Adam Heavenrich of Heavenrich & Company. Built in 2009 on an 80-acre medical campus that is anchored by the Kelsey Seybold Clinic, the facility features 120 beds. Owned by a publicly traded REIT and operated by StoneGate Senior Living, it was around 76% occupied at the time of the sale. The property was well maintained, which a new owner could use to boost census and value. Heavenrich & Company received multiple bids on the facility and ultimately selected O&M Investments, a private equity firm led by Nick Martinez and Todd Okum. The purchase price came to $5.3 million, or... Read More »

SLIB Closes Georgia Assisted Living Sale

At the start of September, Senior Living Investment Brokerage’s Brad Clousing and Patrick Byrne closed the sale of an assisted living community in Woodstock, Georgia. The pair also assisted the buyer in assuming attractive HUD debt on the property with a 2.62% interest rate. We’re sure that motivated the buyer to get the deal done. Originally built in 1996, this community features 33 assisted living units and has historically been well occupied since then. Census dipped in recent months but shot back up to 95% right before close. In the last 12 months, the community brought in nearly $90,000 in EBITDAR on nearly $1.1 million of revenues, so that 8% margin could be improved. It is well... Read More »

Dwight Capital Acquires Love Funding

The HUD market seems to be the steadiest in the senior care lending world since the onset of COVID-19, after a few hiccups and delays earlier this year. Recently, there was a shake-up in the lending market, as Dwight Capital acquired Love Funding, the HUD lending subsidiary of Midland States Bank. Love Funding’s platform will be rebranded and integrated within Dwight Capital, while Midland States Bank will retain the existing Love Funding servicing portfolio. Read More »

Senior Capital Advisors Secures Construction Financing For Florida Property

Bruce Gibson of Senior Capital Advisors successfully closed construction financing for a to-be-built senior living campus with a unique addition to it. Located in the Westchester suburb of Miami, Florida, The Contemporary will feature 85 units of independent living along with MedSquare Place, a 33,000-square foot medical office component on the first floor of the building. We have always been a fan of adding services like these to senior care campuses, which not only add a convenience to the seniors living there but also provide some revenue diversification for the building. The added visibility for the community by patrons of the MOB doesn’t hurt either with its... Read More »

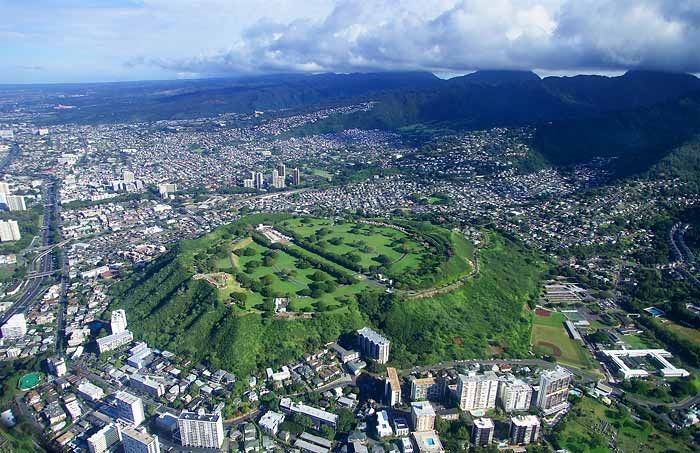

Lancaster Pollard Closes Hawaii SNF Refinance

Lancaster Pollard Mortgage Company followed up its HUD refinance of an assisted living/memory care community in Minnesota for a deal in a much more hospitable year-round climate. Doug Harper and Casey Moore of Lancaster Pollard headed to Honolulu, Hawaii (lucky guys) to arrange permanent financing for a senior living community located on the slopes of Punchbowl Crater, an extinct volcanic cone in downtown Honolulu. Owned by MW Group, Ltd., the community was built in 2003 and renovated in 2017. It currently consists of 68 independent living, 20 assisted living and 20 memory care units, and is one of six seniors housing and care properties in Hawaii operated by The Plaza Assisted... Read More »