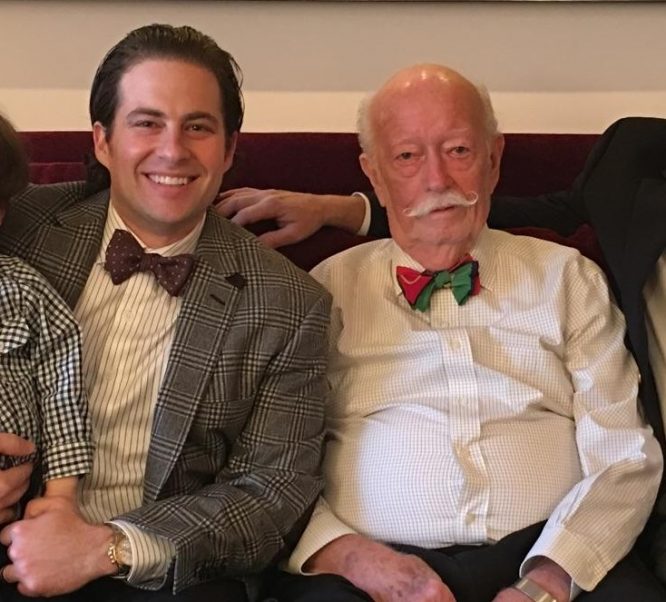

All In The Family

The phrase “it’s not personal, it’s just business,” doesn’t always apply. Sometimes it’s both. That was the case with Ben Firestone’s (of Blueprint Healthcare Real Estate Advisors) latest sale, which was sourced by his 90-year old grandfather. Still involved in the real estate business and showing up to work every day at 90 years old, Ben’s grandfather knew of a friend who owns a paper company in Houston, Texas but also recently decided to build a 98-unit assisted living/memory care community in the area, hiring a third-party manager at the same time. The lead paid off, as Mr. Firestone was able to sell the community (still in lease-up and 70% occupied at closing) to a private equity firm... Read More »

Nice Sale In Bluewater Bay, Florida

American House Senior Living Communities continued its growth in Florida with the acquisition of a 94-unit independent living community, its seventh senior living property in the Sunshine State. There are plenty of things going for this property. It is located in the mixed-use residential/resort community of Bluewater Bay, adjacent to Elgin Airforce Base. So, in addition to enjoying the local amenities, the property also draws some of its census from affluent retired military officers. There is also a large fifth floor bar and lounge, a movie theater, heated pool, full-service concierge and valet parking. It was developed in 2015 by a partnership between Bluewater Commercial Developers,... Read More »

Skilled Nursing Facility Receivership Ends With Sale

A Kansas skilled nursing facility in receivership recently sold with the help of Evans Senior Investments, for an undisclosed price. Built in 1977, the facility has 67 skilled nursing beds and 15 residential care units, and it was 81% occupied. However, despite its location five blocks away from the area’s only community hospital, it was in receivership at the time of listing. ESI represented the court-appointed receiver in the facility’s sale to an experienced operator that plans to use its economies of scale to increase revenues and improve the operating margin. Read More »Recent Senior Care M&A Deals, Week Ending December 1, 2017

Check out our recent senior care M&A deals! Long-Term Care AcquirerTargetPrice Koelsch CommunitiesRock Creek Memory Care CommunityN/A Birchwood Health Care PropertiesQuail Run Assisted Living$6 million Care Property Invest2 Assisted Living Communities$35.7 million Chicago Pacific FoundersNorthgate Park Senior... Read More »

Private Evening in NYC

Members of the American Seniors Housing Association and subscribers to The SeniorCare Investor gathered in New York City on the night of the Rockefeller Center tree lighting in an intimate setting at The Penn Club to hear what Rick Atlas (Atria Senior Living), David Reis (Senior Care Development) and Scott Stewart (Capitol Senior Housing) had to say about investing in seniors housing today. While all three were very bullish on the future of the seniors housing business and long-term investment values, there were certainly differences of opinion as to where they see strength. For example, David Reis stated that not only is the CCRC model alive and well, but several of his CCRCs are... Read More »

Lancaster Pollard Closes HUD LEAN Loans

The transactions keep on coming from Lancaster Pollard. After being revealed last month as the top HUD LEAN lender once again (with 79 transactions and nearly $770 million in volume during HUD’s fiscal year 2017), the firm has closed another two transactions on behalf of California-based borrowers. First, for Summit Healthcare REIT, Jason Dopoulos of LP refinanced four senior care facilities for a total loan amount of $55.1 million. The portfolio features a 181-bed skilled nursing facility in Millsboro, Delaware, a 151-bed SNF in Smyrna, DE, a 69-unit independent living community in Salem, Oregon, and a 66-unit IL/assisted living/skilled nursing facility in Portland, OR. The latter two... Read More »

Meridian Capital Group Nearing $1 Billion Senior Care Year

Meridian Capital Group is fast approaching the $1 billion mark for deals closed in the seniors housing and senior care market and just added four more transactions (and over $73 million) to its total. First, the firm sourced $8.3 million in equity capital on behalf of The Calida Group (a multifamily/seniors housing developer) for a 103-unit assisted living/memory care construction project in Fallbrook, California. Staying in California, Meridian also arranged a $25 million loan, provided by a balance sheet lender, for a 181-bed skilled nursing facility in Santa Rosa, California. The three-year loan, which includes a LIBOR-based interest rate and 12 months of interest-only payments,... Read More »

Atria Senior Living Heads To High-Income Fairfield County, Again

Hoping that success will breed more success, Atria Senior Living just broke ground on an 86-unit assisted living/memory care community in Ridgefield, Connecticut, which will be its fourth in the high-income, highly desirable Fairfield County. Average rents are especially high in the county (often surpassing $10,000 per month for memory care services), and already with locations in Darien, Stamford and Stratford, Atria has successfully established its brand there. Now, to Ridgefield, where Atria and its development partner Formation Development Group broke ground on an 86-unit assisted living/memory care community. Located on a four-acre site that was purchased for $3.2 million, the... Read More »

Senior Housing Innovation Coming Your Way

As the boomers age, and look at alternatives for housing, many seem to be popping up. There has been a lot of noise in the media about the hot new living arrangements for the elderly, or more specifically, the boomers who are soon to be the elderly. Whether it is co-living arrangements in urban environments or Bill (Green House) Thomas’ new idea called a Minka tiny house, which is about 325 to 400 square feet and is modular, or the new active adult communities being developed as 100 to 200-unit apartment buildings for the pre-retirement housing crowd, all these concepts may be giving senior living providers the jitters. They shouldn’t. As far as I can tell, these are all targeting a... Read More »