Skilled Nursing Cap Rates Stable after Record Rise in Price

We are less than a week away from our webinar “Seniors Housing M&A: the Numbers, the Deals and the 2017 Forecast,” where we discuss the results of our soon-to-be-released Senior Care Acquisition Report. Prices have risen to new heights in skilled nursing, nearly surpassing $100,000 per bed at $99,200 per bed. But what happened to skilled nursing cap rates, which most buyers prize far more as a valuation tool than price per bed? In the last couple of years, it has remained remarkably stable at 12.2% (identical to its 2015 level), with just a 20 basis point variance over the past three years. Although not reaching the record-low from the last bull market (12.1% in 2007), skilled nursing... Read More »

Capital One Closes HUD Refinance of Large Illinois SNF

One of the largest skilled nursing facilities in Illinois just received a $16.8 million 35-year HUD refinance, courtesy of Joshua Rosen of Capital One. Located in the town of Joliet (about 40 miles outside of Chicago), the facility serves both Medicaid and Medicare patients in either private or semi-private rooms. In addition to long-term care, it also offers respite care and sub-acute/short-term rehab care (to Medicare patients), encompassing physical/occupational/speech therapy, wound care management, cardiac rehab, trach care and post-stroke management. The facility was built in 1975, but improvements have been made since then. The owning principals, which have operated it since 1998,... Read More »

Brookdale Senior Living Finally Reports

Brookdale Senior Living finally reported fourth quarter earnings, and they were no better and no worse than could have been expected. While I can’t say it was worth the wait, Brookdale Senior Living finally reported fourth quarter earnings, and it was no better and no worse than what could have been expected given industry trends. That was probably good news. Executive Chairman Dan Decker started the earnings call by stating that they would not be discussing strategic options on the call, which was smart, other than to say that of course they want to maximize shareholder value, but it remains to be seen how that is done, and when. Occupancy at Brookdale declined sequentially and year over... Read More »Seattle Seniors Housing Operator Develops Again

Merrill Gardens is growing yet again, through the development of two more assisted living/memory care communities in Washington and Georgia. This comes just months after Seattle-based Merrill and an unidentified partner bought out the majority stake owned by an affiliate of Heitman in a small portfolio of four senior living communities either developed or acquired in the previous couple of years. That sale was arranged by Cushman & Wakefield. But now, the company is growing again in a partnership with its sister company, Pillar Properties. First, in its hometown of Seattle, Merrill opened a community with 91 independent/assisted living and 10 memory care units, at a total development... Read More »

Another Texas Transaction for Blueprint Healthcare Real Estate Advisors

Blueprint Healthcare Real Estate Advisors has developed an affinity for the Texas senior care M&A market, closing six transactions in the state in the last year, including as recently as January, when the firm closed the sale of a 120-bed skilled nursing facility in Whitehouse for $6.42 million, or $53,500 per bed. Now, hired to help a large company divest what it viewed as non-core asset, Tim Cobb and Ben Firestone of Blueprint arranged the sale of a 75-unit/141-bed skilled nursing facility in San Antonio. Included on the campus was a 17-bed assisted living unit, but the facility was struggling operationally, with just a 34% census at the time of the sale. The Ensign Group was the... Read More »

Aron Will Finances Pennsylvania Acquisition

We learned of Care Investment Trust (CIT) and Greenfield Senior Living’s joint venture acquisition of a 120-unit personal care/assisted living and memory care community in Lansdale, Pennsylvania back in January, but just recently bubbling to the surface was the news that Aron Will of CBRE arranged financing for it. Through a regional bank, Mr. Will secured a $10 million, floating-rate loan, with a five-year term and 12 months of interest only. Currently, the community is just 61% occupied based on 150 licensed beds, which Greenfield intends to improve. The operator will also change the name to Greenfield Senior Living of Lansdale. With the joint venture between CIT and Greenfield looking... Read More »

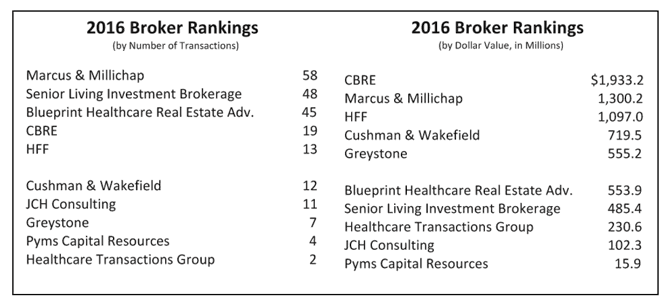

Marcus & Millichap and CBRE Top Senior Care Broker Rankings

While it was not exactly a repeat of 2015, it came pretty close. This year we had only 13 brokerage companies reporting their numbers, with a few active brokers deciding to take a pass this year for a variety of reasons. But they would not have taken the top spots, so no worries on that account. Based on the number of transactions closed in 2016, Marcus & Millichap came out on top for the second year in a row with 58 separate sales in the seniors housing and care market. This was down a bit from the 64 sales in 2015, but the entire market had a mild slowdown. Taking the number two spot for the second year in a row was Senior Living Investment Brokerage with 48 sales, also down from... Read More »High quality facility doesn’t always mean high prices

A five-star rating from Medicare should normally translate to a higher per-bed valuation when a skilled nursing facility changes hands. When you also throw in a recent build (for SNFs) in 2003 and good location in the growing Raleigh-Durham MSA of North Carolina, one would again assume this facility would command a premium in price. However, that was not (exactly) the case in the sale of Treyburn Rehabilitation & Nursing Center, a 132-bed skilled nursing facility. Owned by an in-state skilled nursing facility chain, the building is located on about 10 acres in the city of Durham. It features 50 semi-private and 30 private units, with a high quality mix of 60% (38% Medicare and 22%... Read More »

Ensign Group Shares Plunge

The Ensign Group was the first of the operating companies to report fourth quarter earnings, and the company took a stumble. Earnings were significantly below estimates because of some difficulties transitioning acquisitions, and were also impacted by labor costs and increasing healthcare costs. As a result, management lowered its guidance for 2017 for both revenues and earnings. In addition, occupancy was lower at 74.6% and same-facility occupancy was down nearly 150 basis points year over year. Occupancy at Ensign has historically been lower than its peers because it acquires so many underperforming properties with low occupancy rates that it expects to turn around. We have often... Read More »