Who Is Investing In Skilled Nursing Facilities?

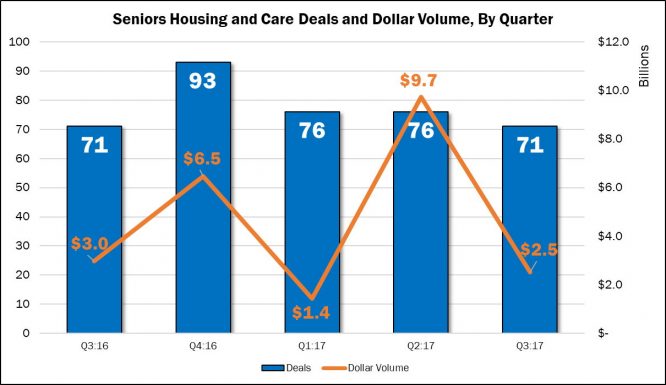

Despite reimbursement pressures and dropping occupancy levels, investment demand for SNFs remains high. But why? Do you want to find out who is investing in skilled nursing facilities and why? Perhaps you may be asking, who would invest in the SNF sector today when reimbursement pressures are growing, labor shortages are hurting, occupancy levels are dropping, and costs in general are rising faster than reimbursement? Actually, a lot of companies are investing in the sector. In fact, in the third quarter, 46% of the targets in the M&A market were skilled nursing facilities or portfolios. And the third quarter was not particularly unusual in this regard. The market remains quite vibrant... Read More »